I come across A LOT of crazy comments and ideas on social media.

Enough to make you lose faith in humanity at times.

Most I can ignore, let go and move on. However, when I see something very misleading by a major influencer that I KNOW will lead everyday Americans to either:

- Believe incorrect information

- Create a further divide than already exists

Well, I can't keep my mouth shut.

The reason that I started She Talks Finance was because I truly have a passion for not only financial literacy (especially for Women) but also financial truths.

Money literally runs our lives. It's the tool that keeps us functioning and gives us security, and a large amount of Americans don't really understand how it works.

It's of no fault of their own. Schools don't teach financial literacy, which is why I love what organizations like Girls Rock Wall Street are doing.

We need more people spearheading financial education for young people. It can change so much!

However, sometimes I think politicians want everyone to stay out of the know, but, that's just me being a conspiracist, I suppose.

Bank Bailout Blunders

So, with all of that said, when I saw this tweet from Bernie Sanders, I just put my face, in my palms.

There are so many things wrong with this tweet…

First off, Bernie is referring to the Troubled Asset Relief Program (TARP) implemented by the government in 2008 to combat the financial crisis (aka: banks giving out subprime mortgages like candy on Haloween).

It was ridiculous and by NO means am I defending the banks. They got greedy, stupid and irresponsible. The crisis caused a lot of people a lot of harm and some are still dealing with the fear to this day.

The 2008 financial crisis was a perfect storm of a mess by all parties involved (lenders, homeowners, underwriters, investors, etc).

However, the government stepped in with TARP to help, so that we didn't go down the toilet bowl even further than we already were.

TARP = the big bailout that everyone is so mad about…still.

Here is the problem though… a lot of people don't know that the banks had to pay back the money (essentially, buying back their stock shares that the government had purchased to give the bank a cash infusion).

It was more of a low-interest loan than a bailout, for most parties involved.

So, let's talk about the bank bailout specifically. This is the one most people are pissed about.

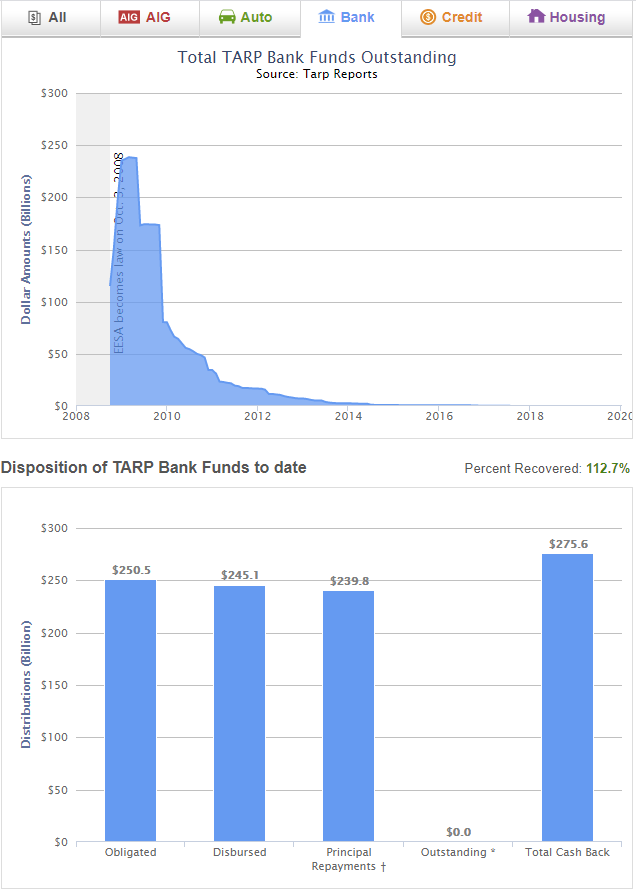

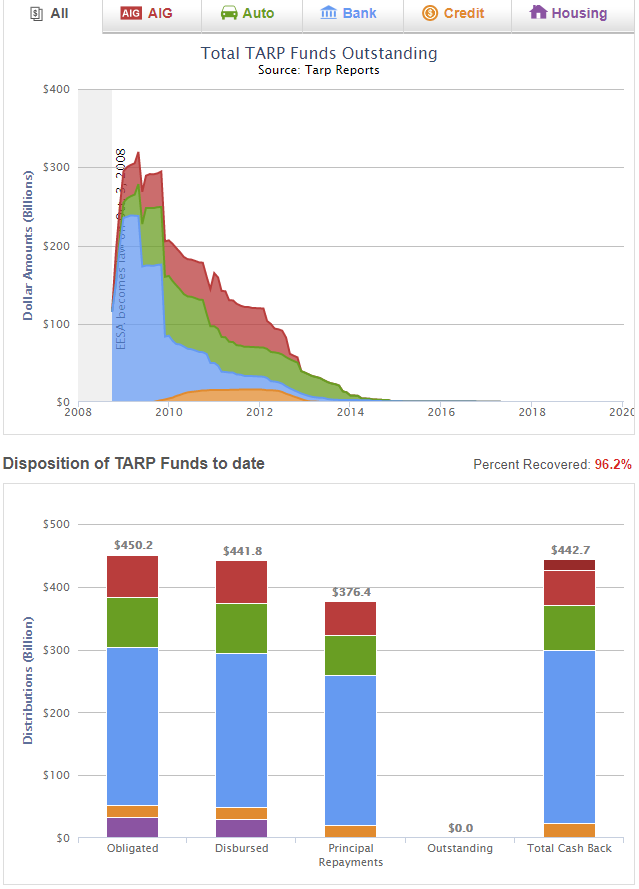

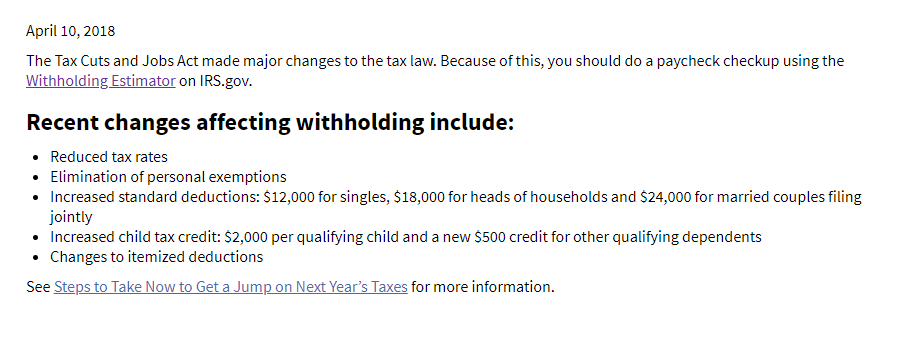

This is direct from the Treasury website:

As you can see, the government has received BACK every penny plus some that they gave to the banks. They have recovered 112.7% of the funds back from the banks.

Here is a view of the total TARP funding throughout all sectors of the bailout (total disbursed $441 billion):

The government has received back 96.2% of all the funds disbursed across all sectors. The sector lagging behind the most? Auto.

Either way, the government didn't just give out money to never receive anything in return. Also, who knows what our lives would have looked like if the government DIDN'T do this. It's hard to say how deep into a depression our economy could have gone into.

So, back to feeling the Bern. The first flaw in Bernie's tweet was that JP Morgan got $416 billion dollars.

That is very incorrect.

- The total bank TARP money provided was $245 billion among ALL banks

- JP Morgan got $25 billion

- JP Morgan didn't even want to take the money but the government made them (they didn't need it)

- They paid it all back

Sorry Bernie, but this was an insanely misleading tweet to push your agenda and get everyone all riled up (because that's just what we need right now in today's political climate).

The Tax Refund Myth

I see bogus tweets from politicians all of the time.

It doesn't matter if you're feeling the Bern or want America to be great again.

They say whatever they think will make you angry enough to stand beside and vote for them.

Here is an example of a tweet from Kamala Harris (don't worry, I have a Trump one coming up, shortly so that you see I'm not biased):

Where my CPA's at? This one is good…

All financial experts know that your tax refund is NOT the proper way to measure what you paid in taxes, ESPECIALLY after the new tax laws went into effect.

Why you ask?

Because for one, our tax withholding tables changed to reflect the new tax law, LOWER tax brackets and HIGHER standard deduction (from around $6,000 to $12,000 per person).

So, your employer should have withheld a different amount than before.

Most likely, a lower amount, because: lower tax rates + higher standard deduction = lower tax liability for most Americans.

So, yes, this may have changed your refund, but it doesn't mean you paid more in tax.

The IRS even told everyone to do a paycheck checkup. However, most Americans probably did not, and they probably just assumed they paid more in taxes because their refund was lower.

Also, you can change your withholding with your employer to take more or less tax out. If you fill the withholding form out incorrectly, your refund will be affected accordingly.

The ONLY way to know if you paid less or more tax, is to compare your taxes paid to your taxable income.

Taxes paid ÷ Taxable income = Effective tax rate (%) paid

I'm not saying the new tax law didn't screw some people into paying more tax (like wealthy homeowners in California and New York, mostly), but I am saying this tweet was misleading and meant to make people angry.

By the way, your tax refund is money that you already owned and simply lent to the government interest-free.

So, it's always a good idea to do a paycheck checkup to see if you can get more money in your pocket throughout the year.

If you're bad at saving… maybe keep the withholding higher to be sure your tax liability is fully covered.

Unrealistic Return Expectations

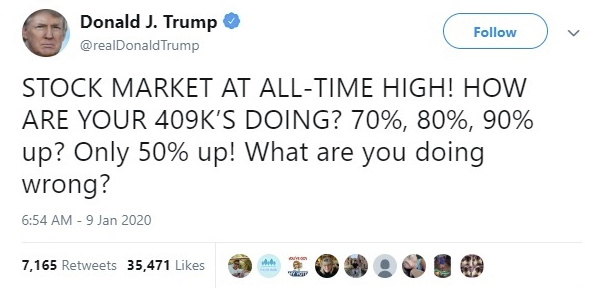

Okay, let's talk about the Trumpster.

Yes, he has since corrected his 409(k) blunder… but, I have to say thank you, because financial Twitter (Investors, Financial advisors, etc…) had some hilarious memes and comments.

So, now that we know a 409(k) is not a thing (it's a 401(k)), we can address the INSANE returns he is referring to.

First of all, he's making it sound bad if you got a 50% return (at least that's how I read it).

Considering the average return of the S&P 500 is 7% after inflation, a 50% return is AMAZING!! Also, it's very difficult to achieve without an extremely risky allocation.

I hope Americans do NOT feel bad if they got a 50% return (which is highly unlikely if they are diversified well).

70%, 80%, 90% returns? This is not only unrealistic (unless you're investing in cryptocurrency, but that's a whole different story) but unfair to make Americans think they should be achieving.

I can't help but wonder how many financial advisors got the call that day “Ummm, why is my account only up 15%, Trump said I should be up at least 90%”.

Good grief.

He's trying to paint the picture of an amazing economy (to get votes), I get it, and the economy is humming along well, however, these returns he speaks of in this tweet are unrealistic.

Free Money

Okay, back to Bernie for my last point (I really DON'T mean to pick on him, he seems like a nice dude).

I've seen people over time comparing the bank bailout to the student loan forgiveness proposal.

Comments I saw included things like:

So, Sanders has promised that student loan debts will simply go away, and they will be completely forgiven. Poof, student debt gone.

To set the record straight, I am not against helping the American people.

However, if we call the bank bailout what it really was, a low-interest loan, then if people want a student loan debt bailout, then that's what they should expect… a low-interest loan.

Not a poof-be-gone debt scenario.

I'm actually all for helping students get lower interest rates on their student debts or debt restructuring. The interest is what is really killing them half of the time.

6-8% interest rates on average is high for this kind of debt. If you're just getting by with the minimum payments, of course, that is going to be hard to pay off if you have a high debt load.

So, I wouldn't be opposed to a bank like bailout for holders of student loan debts. But, they have to pay something just like the banks did.

Let me put this into some financial perspective, though.

The total TARP bailout was $441 billion dollars.

The student loan debts have tallied up to over $1.6 TRILLION dollars.

The student loan “bailout” would be 3.6X the size of the TARP bailout.

Is a bailout of this magnitude even REALLY necessary for most Americans?

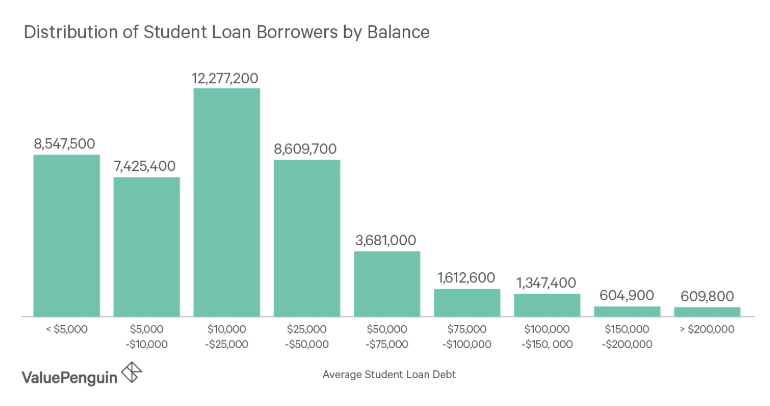

Before you bite my head off, let's take a look at the student loan balances held:

Most of the balances are under $50,000. Many being less than $25,000.

The question everyone should REALLY be asking is how large is their student loan payment as a percentage of their income? Also, what percentage of your total debts is your student loan?

Considering that a college graduate earns 80% more money than a noncollege graduate, taking out a student loan can make a lot of sense in the long run.

So, is it REALLY necessary for everyone with student debt to get a pardon?

At least Warren's proposal has some income criteria to qualify (if you make over $250,000 you get no debt cancellation).

My main point with this post, is to show you that politicians stretch truths, sometimes outright lie and say what they think will make you side with them.

Instead of taking what they say as fact.. do your own fact-checking, educate yourself, then draw your own conclusions!

Politicians should be afraid of a more educated population, especially financially.

Knowledge is power.