Feeling bad about renting your home and not owning something? You're not alone.

The number of people choosing to rent over buying their home is growing (sorry, Real Estate agents). Surprisingly, this view spreads from Baby Boomers to Millennials according to a 2018 February Harris Poll.

There are two main reasons that people are choosing to rent over buy. They either can't afford it, or they think renting suits their lifestyle better.

Whichever reason has you feeling guilty for paying the landlord month after month, there are many reasons not to feel down about it.

Renting has its Perks

Clogged tub drain? Air conditioning goes out? Leak in the ceiling? There's a maintenance man for that. Believe it or not, maintenance on a home can get quite expensive. Especially if your home is older.

There is a general rule of thumb that you should set aside 1 percent of the purchase price of your home for maintenance every year. So, if you have a $200,000 home, you should set aside $2000 a year for keeping up with things.

You may not spend all of that money that year. However, you should let it roll over into your next year's funds to grow for big jobs like a new roof or a new air conditioner. These are going to be some of your largest fixes next to interior aesthetic updates.

Not to mention, there are property taxes. Depending on where you live, these costs can be a sizable chunk of your monthly mortgage payment when you own.

So, the true cost of owning a home is actually the purchase price, plus property taxes, mortgage interest, and maintenance.

Although you may down the road sell your home for more than you bought it for, you have to keep these sometimes forgettable expenses in mind to see your true return on your investment.

In some cases, when comparing the mortgage of a home you want to buy to what a comparable home would be to rent, the rent may be significantly cheaper. It might make more sense to save that monetary difference for a bit and build up a down payment.

But, it's the American Dream to Own a Home

Is it though?

Can you still have financial well being and wealth while renting a home? Sure you can. Being flexible may even be better for your financial situation if it allows you to follow better-paying career opportunities.

Owning a home doesn't define your success. It's a great thing down the road to have a paid off home, but it doesn't mean you're not living the dream if you don't own now or ever.

There are many people actually opting for a nomadic lifestyle on purpose, which I have done with my husband at many points in my life myself. It's a good feeling when you're an adventurer to know that you can pick up and move to a new location every year and have new experiences.

If you're anything like me, I'm not even 100 percent sure where I eventually want to settle down and own a home. So this gives me the opportunity to explore and figure it out.

There is an opportunity cost to keep in mind. By renting, you're given an option every year to make a new choice. Some people may not need this option at all, and others think it's well worth the rent payment (or RV payment if you're really adventurous).

People are also getting married and having babies later in life, and there is nothing wrong with waiting for these big life events before making a huge commitment to a mortgage. Owning a home makes a lot more sense if you plan to stay put for a while.

The Scars of the Financial Crisis of 2008

Many people still have the scars from the housing market collapse and they're simply afraid to buy a home.

I remember seeing the euphoria from people I knew telling me about the astonishing appreciation they had in their homes only to be completely in the red shortly after.

It was foreclosure central all over the nation, and it left a mark on many of us no matter what generation you were.

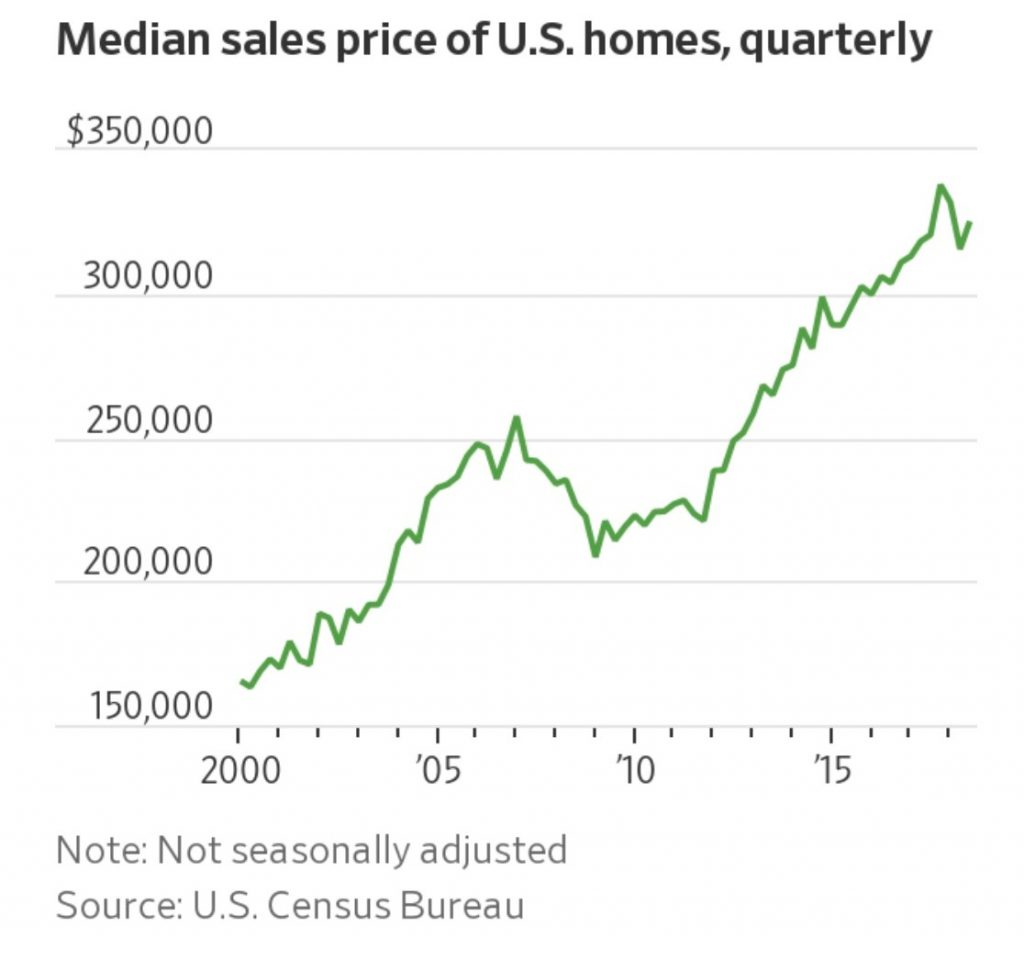

With housing prices increasing year after year in many markets, it's simply becoming too expensive. Flashbacks of what happened still crosses our minds.

The good news is, if fewer people are buying, demand is shriveling up which could, in turn, bring down prices.

The other good news is that the housing crisis was driven by bad loans being made to people that shouldn't have gotten a loan in the first place. They either couldn't afford the payments, had bad credit or both. Despite these things, the banks were giving loans out anyways. It was a frenzy.

The banks since then have tightened that up. They have been regulated and mortgages are being given to qualified buyers who have good credit and prove they have the income to afford it.

You Can Enjoy Renting While Still Planning to Own in the Future

If you're still fairly young and you're renting, simply enjoy the optionality that you have and look at it as an asset while you plan for the future.

Focus on things like building up savings, growing your money with compounding interest, and investing in your retirement.

You can do all of those things mindfully, with the eventual goal to own your home when the time and money is right, and not feel guilty about that next rent check.